- Home

- Media Kit

- Current Issue

- Past Issues

- Ad Specs-Submission

- Ad Print Settings

- Reprints (PDF)

- Photo Specifications (PDF)

- Contact Us

![]()

ONLINE

Sanford I. Weill and his wife, Joan

A Business Philanthropist

Editors’ Note

In 1955, Sandy Weill graduated from Cornell University and began his career as a runner for Bear Stearns before becoming a broker. After a storied 50-year career on Wall Street, he retired as CEO of Citigroup in 2003 and retired as non-executive Chairman in 2006. Weill was the recipient of Financial World Magazine’s CEO of the Year Award in 1998 and received the same honor from Chief Executive Magazine in 2002. He is Founder and Chairman of the National Academy Foundation (NAF) (since 1980); Chairman of the Executive Council of UCSF (since 2015); Chairman of the Lang Lang International Music Foundation (since 2015); President of Carnegie Hall (Chairman for 24 years, on board for 37 years); and Chairman Emeritus of Weill Cornell Medicine (Chairman for 20 years, on the board for 35 years). Weill is a member of the prestigious American Academy of Arts & Sciences, and he and his wife of 61 years, Joan, are recipients of the 2009 Carnegie Medal of Philanthropy.

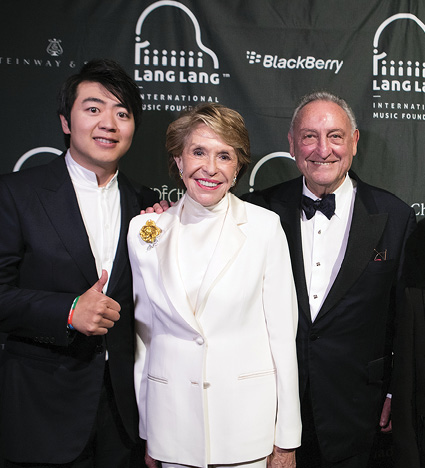

Sandy and Joan Weill with Lang Lang

Throughout your philanthropic efforts, you’ve remained focused on education, health, and music. How important is it to put a heavy focus on certain areas where you can make the most impact?

When one decides to work on something philanthropic, it’s very important to work with a person or an institution that is very good or that has the ability to become very good. It’s easier to make something that is good better rather than trying to correct something that is a disaster.

Everything we do has an element of education associated with it, for instance, the NAF program, which reaches high school students and where we now support 675 academies and just under 100,000 students. Of the seniors from last year’s class, 98 percent graduated and more than 92 percent went on to college. This is impressive because 75 percent of the students are on food stamps and come from the lowest part of the economic spectrum.

We have programs at Carnegie Hall in our Weill Music Institute that have provided 500,000 children in second, third, and fourth grades with music education through local orchestras. I’ve also started a program with Lang Lang to teach piano to students in grade school. Unlike most artists, Lang Lang not only gives of his time and brain power, but also his money. We are looking to possibly include the program at Carnegie Hall with a partnership, which means we will be able to impact even more lives.

The federal government is cutting back on the National Institute of the Arts, as well as NIH funding. They decided to take music out of the classroom, even though it has been proven scientifically that if a young person has a connectivity to a musical instrument in their formative years, their brain is likely to grow larger than one who does not. Research shows they will do better in math and science, and these subjects are the areas where it’s easier to make a higher salary.

Joan and I have continued to concentrate on what we started, which began in the early ‘80s – NAF was founded in 1980. I was the Chair of Carnegie Hall for 24 years and on the board for 37. Joan was on the board of Alvin Ailey for 22 years and Chairman for 14. We have helped transform those organizations, along with their terrific leadership, to be at the top of their games. We have done the same at Weill Cornell Medicine where we have expanded our research. At New York-Presbyterian, we have the best clinical practice in the city.

We’re now doing similar work in California where we have reinvented ourselves. We have built a music hall at Sonoma State, which has been very successful and may have the best acoustical properties of any music hall of its type.

We have also made a large gift to UCSF’s neurosciences program, which we’re excited about. Shortly after our gift, Mark Zuckerberg and his wife, Priscilla, announced a $3-billion gift to basic sciences at the UCSF campus at Mission Bay. This program will be run by Dr. Cori Bargmann from Rockefeller who is a neuroscientist, and it will bring together great people from Stanford, Berkeley, and UCSF to work on projects.

Why was your transition from business to philanthropy so seamless?

Unfortunately, a majority of CEOs feel they do enough when they give their money to their foundation and somebody else runs it. I’ve always been a micromanager, which made it easier for me to believe – and my wife believes in the same thing – that philanthropy is not just about giving money away but about being involved in a cause with your time, passion, energy, and intellect. What makes one successful in business could be of great value in helping a public institution do better, and we are often able to demand more than what the federal or state governments might demand of people. For us, if there is no performance, then there won’t be a second gift.

It makes business sense for a CEO to be involved in philanthropy. Employees see how a company is respected more for giving back, and the CEO can get the employees involved in working in different institutions in their local communities as a result. The employees quickly become aware how they really can help change someone’s life.

Do you feel it is a good thing for companies to tie doing good to doing well on their bottom line?

It’s a very good thing, especially at a point in time when people are shooting down companies and when there’s such a great disparity between the haves and have-nots.

The way we will intelligently narrow that disparity is through education. We need to educate people to see where there are better jobs and how they can study successfully, dress appropriately, and feel good about themselves. That is a more productive way than taking from the top and giving to the bottom and expecting nothing.

There is an underlying frustration that no matter what steps are taken, the education system remains broken. With NAF, the numbers speak for themselves. Can that program be replicated, and when you have a model that works, is it frustrating to see that others haven’t gotten onboard?

Yes. We have grown from one academy of finance to 675 academies in 461 schools with close to 100,000 students with programs in hospitality and tourism, and STEM programs in engineering, information technology, and health sciences where there are tons of jobs available. We now have eight million people unemployed and nearly six million unfilled jobs in the U.S. for which we haven’t been able to find people with the abilities required to fill those jobs. We are working to overcome this through education and mentoring, as well as internships and training.

How important has it been to have consistent leadership within NAF, and does it all start with the talent you can find?

That is always the case. We have really good people running everything we give our money to. The fact is, people who are the best at what they do want to stay a long time because they really want to make a difference. What philanthropists can do is supplement that with a common sense point of view about how to run a business. The person running the program really knows the area of focus, be it medicine, science, research, music, or education but, with philanthropists as partners, we can help build it into something much better than it was before.

Many of those who have worked with you have had great success. What do you look for in people?

We’ve been lucky, but we look for people that have a heart and soul and really care about making a difference in people’s lives. No matter where people are from, we all have the same desires for our families to be able to build a more secure future and better quality of life. We try to develop that by making everybody a partner so they all become shareholders and personally benefit by having made something better.

We had a rule in our company that the top 35 people, which were the very senior management, could not sell any of the company stock until they retired. The only thing they could do was give away a percentage of their stock to charity.

Of course, if we didn’t do well in the short term, we wouldn’t do well in the long term, so we have to balance that, but we didn’t have people pumping up earnings just to get out. As a result, over time, we built something substantial.

How concerned are you over the kind of cultural divide we are currently experiencing?

It concerns me a lot, which brings up a good point with work we did at Weill Cornell from 2000 to 2001. We were talking to people from Qatar about building a medical school at that time. Over the course of a year, we convinced them to have all of the governance rules we have in the United States – co-ed classes, blind admissions, no favoritism for royal families, all of the things that make a good institution.

At that time, there were many people who felt that it was wrong for any institution to do something in an Arab country until there was peace between the Palestinians and Israelis. I disagreed with that because I think the way we will create peace is by bridging these cultural divides, and one great way of doing that is through education and working together.

We signed an agreement in 2001, and the kids there have done very well. Their academic standing is every bit as good as it is in New York. Around 95 percent want to do their residencies in the U.S. and, last year, all but one matched. We have 101 graduates a year in New York and 43 in Qatar now. I’m very worried at this time because some of these young people come from areas like Iran and Syria, but they’re terrific kids and they will grow up in that part of the world with an understanding of America. We’re now chasing immigrants out after they come here to get Ph.D.s rather than getting some of the benefit of that before they return to their countries and perhaps never come back.

Have things really changed when it comes to financial regulation?

Yes, and for the worse by a broad margin. The bill that was passed was 2,500 pages long. If we really wanted to control risk, we could have done it in one page. The Volcker Rule still hasn’t been completed, and it has been eight years since the collapse. Companies are spending so much money and effort dealing with regulations rather than being productive and efficient. I am concerned that this environment doesn’t allow anyone to make a mistake. If nobody can make a mistake and learn from it, nothing entrepreneurial will ever happen, and the financial services industry won’t be able to attract the best and the brightest.

Could you have built what you did in today’s world?

No, because it’s against the law to build something in the financial industry. It’s a shame because we had the greatest financial industry in the world in this country. Mistakes were made, but everybody contributed to the financial collapse.

Many young people today are concerned about their future. What do you tell them to do early on so as to build sustainable careers?

Everyone can learn a lot by going into coding, which provides a $90,000 starting job rather than starting at $30,000 where you don’t know how long it will last.

Goods and services should go to the lowest cost provider of a quality product. In this way, people in America benefit by being able to buy goods at cheaper prices that are made someplace else. However, we have to educate our people about where the jobs are and where the growth industries are for the future. We need to have more people thinking like disruptors in fields like education and medical research.

America has led the world for a long time, but unless we think about changing and not trying to protect the past, we’re not going to continue to be a leader.

Are the legacy industries and companies we think of still getting top talent?

People want to work at a place where their compensation is not questioned in the newspaper all the time. Financial services is still a great industry. Over the past 15 years, well over a billion people in the world went from abject poverty to the middle class as defined by where they live. Much of that happened because our financial industry expanded to communist countries like China and Russia where we taught them about capitalism and public markets.

Do you take time to appreciate your accomplishments?

I do enjoy what I’m doing. I don’t think I would be good at it if I didn’t believe in it, but I’m always thinking about what’s next because if not, we’ll be left behind.•